Understanding Competitive Exness Fees for Traders

Exness has established itself as a prominent player in the online trading market, primarily due to its competitive fee structure. This article will delve into the aspects of Exness fees, aiming to provide traders with comprehensive knowledge about potential costs that could affect their trading performance. The analysis will highlight how these fees compare to other brokers in the market, making it easier for traders to identify value for money in their trading experience. For a more in-depth evaluation, visit Competitive Exness Fees http://www.sempeeters.nl/1/exness-evaluation-2025-12/.

1. Overview of Exness Fees

Exness offers a range of trading accounts tailored to different levels of trader experience. Each of these accounts comes with its distinct fee structure, making it crucial for traders to select the account that fits their trading style and investment goals. The primary components of Exness’s fees include spreads, commissions, and overnight financing fees.

2. Spreads: The Cost of Trading

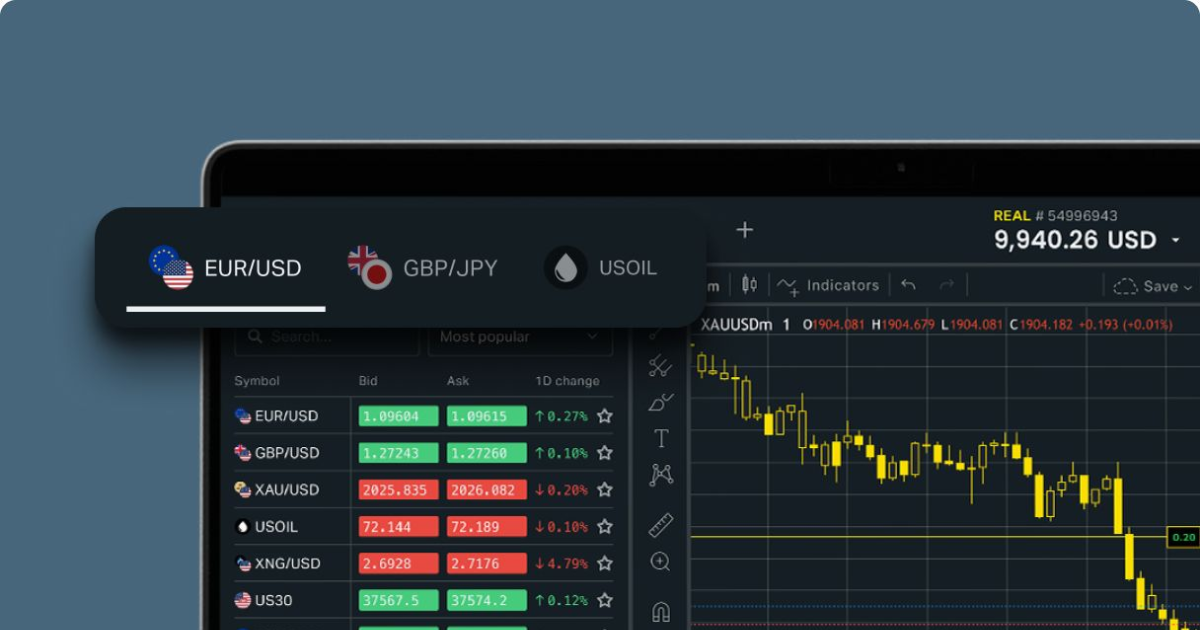

Spreads are essentially the difference between the bid and ask price of an asset, and they represent the primary cost of trading. Exness is known for its competitive spreads, often starting from 0.0 pips depending on the account type and market conditions. The standard accounts typically exhibit wider spreads, while the ECN and Raw Spread accounts usually offer tighter spreads suitable for active and high-frequency traders.

Comparing Spreads

To give you a clearer picture of Exness’s competitive edge, consider this comparison:

- Standard Account: Spreads can start from 0.3 pips on major currency pairs.

- Raw Spread Account: Tighter spreads starting from 0.0 pips, but comes with a commission.

- ECN Account: Designed for high-volume traders with minimal spreads based on market liquidity.

3. Commissions: Understanding the Costs

While some accounts at Exness do not charge commissions, others do, depending on the type of account you choose. For example, the Raw Spread account charges a small commission on each trade. This can vary based on trading volumes, so high-frequency traders may find that these fees are offset by the reduced spread.

Commission Breakdown

For the Raw Spread account, the commission is typically around $3.5 per side for Forex contracts. This means that for each trade executed, traders will pay a total of $7 (both buy and sell) in commissions. However, for those opting for the Standard account, the absence of commission fees allows traders to focus solely on spreads.

4. Overnight Financing Fees

Overnight financing fees, also known as swap rates, apply when a position is held overnight. They can either be positive or negative, depending on the asset and the direction of the trade (buy or sell). Exness offers the option to choose swap-free accounts, which are beneficial for traders who cannot pay or receive swaps for religious reasons.

How to Calculate Overnight Fees

The overnight fee is typically calculated based on the interest rate differential between the two currencies in a forex pair. Traders can gauge these fees through the Exness trading platform, where the swap rates are disclosed for each instrument.

5. Competitive Edge in the Market

When it comes to comparing Exness fees with competitors, it’s essential to look at the overall trading conditions. Many brokers have differing fee structures, and while some may charge lower spreads, they might offset this with higher commissions or overnight fees. Exness has positioned itself competitively, not only with low fees but also with a reliable trading platform and exemplary customer service.

Why Choose Exness?

Several factors make Exness a suitable choice for traders:

- Highly competitive spreads, often lower than industry averages.

- No deposit fees for various payment methods.

- Several account types catered to different trading needs.

- Robust customer support available in multiple languages.

6. Conclusion

Understanding the fee structure at Exness is vital for making informed trading decisions. Whether you’re just starting in the forex market or are a seasoned professional, knowing how competitive Exness fees compare to those of other brokers can significantly influence your trading strategy. With low spreads, tailored commissions, and the option for swap-free accounts, Exness continues to attract traders globally, ensuring that their trading experience is both economical and efficient.

As you embark on your trading journey, always make sure to give careful consideration to the fee structures of any broker, including Exness, to optimize your trading outcomes.