Mastering Forex Trading with Exness: A Comprehensive Guide

Forex trading with Exness offers a gateway to the world of currency exchange, where traders can capitalize on fluctuations in the market. With a robust trading platform, competitive spreads, and a variety of trading instruments, Exness is an attractive choice for both beginners and experienced traders alike. To get started with Exness, visit forex trading with Exness http://www.thinkwatt.me/login-exness-for-india-33/ and explore your options.

Understanding Forex Trading

The foreign exchange market, or forex, is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, which are restricted by operating hours, forex trading occurs 24 hours a day, five days a week, providing traders with the flexibility to trade at their convenience. The goal of forex trading is to profit from changes in currency exchange rates, leveraging fluctuations to make gains.

What is Exness?

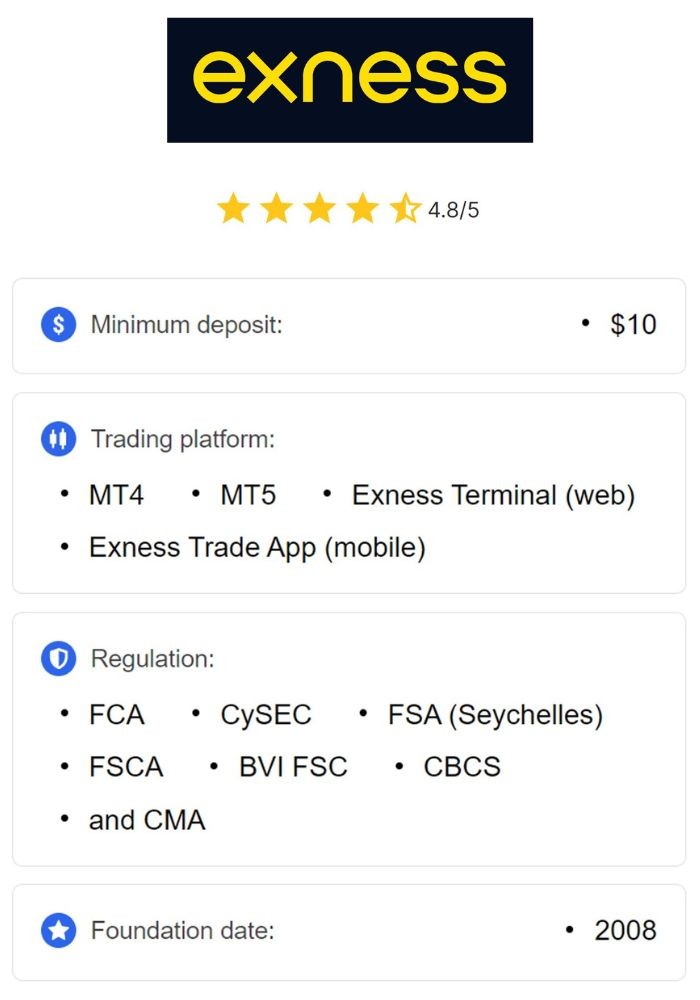

Established in 2008, Exness is a globally recognized forex broker that caters to the diverse needs of traders. It is regulated by several authorities, ensuring a secure trading environment. Exness offers various account types, including Standard and ECN accounts, tailored for different trading styles and preferences. The platform is known for its user-friendly interface, making it suitable for both beginners and seasoned traders.

Getting Started with Exness

Opening an account with Exness is a straightforward process. Interested individuals must visit their website, fill out the registration form, and verify their identity. After completing these steps, traders can deposit funds using multiple payment methods, including bank transfers, credit/debit cards, and e-wallets. Exness stands out for its low minimum deposit requirements, allowing more individuals to participate in forex trading.

Trading Platforms Offered by Exness

Exness provides access to several trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms have garnered popularity among traders for their advanced charting tools, technical analysis features, and customizable user interfaces. MT4 is renowned for its algorithmic trading capabilities, while MT5 supports a wider range of trading instruments, making it suitable for comprehensive trading strategies.

Understanding Leverage and Margin

Leverage is a crucial concept in forex trading that allows traders to control larger positions with a smaller amount of capital. Exness offers flexible leverage options, enabling traders to adjust their risk exposure according to their trading strategies. However, while leverage can amplify profits, it can also magnify losses. Therefore, it is essential for traders to understand risk management principles and utilize appropriate position sizing.

Types of Orders in Forex Trading

Forex trading with Exness allows for various order types, including market orders, limit orders, and stop-loss orders. Market orders are executed at the current market price, while limit orders enable traders to set a specific price at which they wish to buy or sell a currency pair. Stop-loss orders are crucial for managing risk, allowing traders to exit a position when it reaches a predetermined loss threshold.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in forex trading. Traders should consider their risk tolerance, trading goals, and market analysis when developing a strategy. Common strategies include day trading, swing trading, and scalping. Each approach has its advantages and disadvantages, and traders should choose the one that aligns with their individual trading style and situation.

Utilizing Technical and Fundamental Analysis

Successful forex trading hinges on a trader’s ability to analyze the market effectively. Technical analysis involves the study of historical price data, chart patterns, and indicators. This type of analysis helps traders identify potential entry and exit points based on price movements. On the other hand, fundamental analysis evaluates economic factors such as interest rates, employment figures, and geopolitical events. Combining both analyses can enhance trading decisions.

Risk Management in Forex Trading

Risk management is a cornerstone of successful trading. Traders must assess the potential risks of each trade and employ strategies to minimize losses. This includes setting stop-loss orders, diversifying trades across different currency pairs, and limiting the size of each position relative to the trading account balance. By adopting strict risk management measures, traders can protect their capital and sustain their trading activities over the long term.

Exness Customer Support and Resources

Exness prides itself on its exceptional customer support. Traders can reach out to their support team via live chat, email, and phone, ensuring assistance is readily available for any inquiries. Additionally, Exness provides educational resources such as webinars, tutorials, and articles to help traders develop their skills and knowledge. Utilizing these resources can significantly enhance a trader’s understanding of the forex market.

Conclusion

Forex trading with Exness opens up numerous opportunities for traders seeking to engage with the global financial market. With its wide array of trading instruments, various account types, and supportive trading environment, Exness allows both beginners and professionals to thrive. By adhering to disciplined trading practices, implementing effective risk management strategies, and constantly seeking to enhance their knowledge, traders can maximize their potential for success in forex trading.